In a world where economic landscapes fluctuate and personal financial situations evolve, individuals often find themselves considering avenues to unlock the inherent value stored in their gold assets. Whether it be treasured jewelry passed down through generations, coins acquired as investments, or even dental gold with hidden worth, the decision of where to sell gold becomes pivotal. In this guide we will delve into the diverse options available, ranging from local establishments to online platforms, guiding you through the intricacies of each avenue and empowering you to make informed choices that align with your unique circumstances and objectives. As we navigate the labyrinth of gold-selling options, we aim to shed light on the considerations, advantages, and potential pitfalls associated with various outlets, ensuring that you embark on your selling journey armed with knowledge and confidence.

What is the Best Place to Sell Gold Online?

When it comes to selling gold, finding the best place to maximize your returns is crucial. Among the various options available, reputable online gold buyers consistently emerge as a top choice for convenience, competitive pricing, and a streamlined process. Online platforms offer the advantage of reaching a wide market, allowing you to receive quotes from multiple buyers and select the most favorable offer. Additionally, the transparent nature of online transactions, coupled with the ease of shipping gold items, makes the process efficient and accessible. Before finalizing any transaction, it's essential to research and choose a trustworthy online buyer with positive reviews to ensure a smooth and secure selling experience.

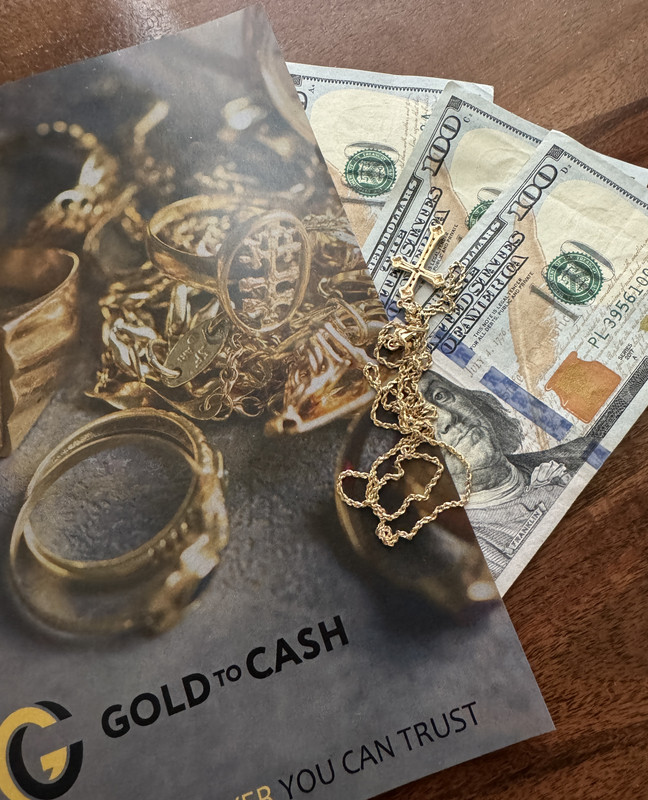

We are confident that Gold to Cash is the best place to sell gold online. Here are some key points that make us the top gold buyer:

- We ensure the best value for your gold, coins, diamonds surpassing any competitor's prices.

- All payments are promptly processed within 24 hours for your convenience.

- Complimentary shipping materials and free FedEx pickup right from the comfort of your home.

- Your shipment is eligible for insurance coverage of up to $100,000, providing added peace of mind.

- Recognized as the best gold buyer by The Penny Hoarder, Think.Save.Retire, Top Consumer Reviews - our commitment to excellence is evident.

- Unmatched reputation in the industry, supported by numerous 5-star reviews on Trustpilot and Better Business Bureau.

- For items returned to us within 7 days, enjoy a bonus of 10%.

- Your satisfaction is our priority at every step of the selling process.

Sell Gold Online or Near Me?

If you're still deciding where to sell gold, a crucial decision arises: whether to pursue online gold buyer or rely on local establishments. Both avenues present distinct advantages and considerations, making the choice a nuanced one. Lets look into the key factors to help you decide whether selling gold online or locally aligns better with your preferences, needs, and expectations.

- Convenience and Accessibility:

Local Option: Local gold buyers, including jewelry stores and pawn shops, offer the convenience of immediate, face-to-face transactions. The ability to visit a physical location and interact directly with buyers can be appealing, especially for those who prefer a personal touch.

Online Gold Buyer: Selling gold online provides unmatched convenience. With just a few clicks, you can access a broader market and receive multiple quotes from reputable buyers. The process is streamlined, allowing you to complete the transaction from the comfort of your home.

- Pricing and Competition:

Local Option: Local establishments may offer competitive prices, but they may not match the breadth of competition seen online. Prices can vary significantly between different local buyers, necessitating thorough research and negotiation skills to secure the best deal.

Online Gold Buyer: Online platforms, by their nature, foster fierce competition among buyers. This competition often results in more competitive pricing, ensuring that sellers have the opportunity to receive the best possible value for their gold. The ability to compare multiple offers empowers sellers to make informed decisions.

- Security and Trust:

Local Option: Face-to-face transactions may instill a sense of security, as you can physically hand over your gold and receive immediate payment. However, the reputation of the local buyer and their adherence to ethical practices should be thoroughly researched.

Online Gold Buyer: Reputable online gold buyers often have stringent security measures in place, including insured shipping and transparent transaction processes. Trusted online platforms are backed by reviews and ratings, offering a level of transparency that can aid in building trust.

- Speed of Transaction:

Local Option: Local transactions typically provide a faster turnaround, as you can receive payment immediately. This immediacy may be beneficial for those seeking quick access to funds.

Online Gold Buyer: While online transactions may take a bit longer due to shipping and processing times, the convenience of shipping materials provided by online buyers and the ability to arrange for a FedEx pickup can streamline the process. Payments are often processed promptly, with many buyers committing to a 24-hour turnaround.

Results:

In the choice between selling gold online or locally, there is no one-size-fits-all answer. Your decision should hinge on your priorities, whether it be the immediacy of a local transaction, the convenience of online platforms, or the desire for competitive pricing. By carefully considering the factors outlined above, you can make an informed choice that aligns with your preferences and ensures a successful and satisfying gold-selling experience. However, based on the most important factors in selling gold we have a clear winner - Online Gold Buyer. With a score of 4:2 in favor of online gold buyers, they surpass local buyers in both providing the best returns for your gold and inspiring trust, backed by real customer reviews.

10 Factors to Consider Before Choosing the Gold Buyer

When making the decision of whether to sell gold online or locally, several crucial factors should be carefully considered to ensure a well-informed and advantageous choice. These factors include:

-

Convenience:

- Local: Offers immediate, face-to-face transactions.

- Online: Provides the convenience of remote transactions from the comfort of your home.

-

Pricing and Competition:

- Local: Prices may vary between establishments; but usually much lower compared to online platforms

- Online: Fosters competition among buyers, often resulting in more competitive pricing.

-

Security and Trust:

- Local: In-person transactions may instill a sense of security.

- Online: Trusted platforms implement secure measures, with the reputation backed by reviews and ratings.

-

Speed of Transaction:

- Local: Generally offers a faster turnaround, with immediate payments.

- Online: While shipping may add some time, it provides convenience and prompt payment processing.

-

Reputation and Reviews:

- Local: Relies on local reputation and word-of-mouth.

- Online: Reputation is often supported by reviews and ratings from a broader customer base.

-

Insurance and Shipping:

- Local: Typically involves no shipping; items stay in your possession.

- Online: Provides insured shipping options with materials provided, ensuring secure transportation.

-

Payment Options:

- Local: May offer immediate cash payments.

- Online: Often processes payments promptly, with various payment methods available.

-

Comparing Multiple Offers:

- Local: Requires visiting multiple establishments to compare offers.

- Online: Allows for easy comparison of multiple offers from different buyers.

-

Global Market Access:

- Local: Limited to local market dynamics.

- Online: Provides access to a broader market, potentially influencing better pricing.

-

Transaction Transparency:

- Local: Face-to-face transactions may offer more immediate transparency.

- Online: Transparent processes with online platforms may contribute to overall transaction clarity.

By carefully weighing these factors and aligning them with your specific priorities, you can make a decision that optimally suits your needs and ensures a satisfactory gold-selling experience, whether online or locally.

What Are Your Local Options?

When considering selling gold locally, several viable options exist, each with its unique advantages and considerations. Here are some local options to explore:

-

Local Jewelry Stores:

- Advantages:

- Personalized service with face-to-face interactions.

- Potential for negotiations on pricing.

- Considerations:

- Prices may vary between different jewelry stores.

- Limited to the local market.

- Advantages:

-

Pawn Shops:

- Advantages:

- Quick and straightforward transactions.

- Immediate cash payments.

- Considerations:

- Offers may be lower compared to other buyers.

- Reputation and reliability vary.

- Advantages:

-

Coin Shops and Numismatists:

- Advantages:

- Specialized knowledge of coins and collectibles.

- Potential for higher prices for unique items.

- Considerations:

- Prices may depend on collector demand.

- Limited to coins and collectibles.

- Advantages:

-

Local Gold Parties:

- Advantages:

- Social and informal selling environment.

- Potential for immediate payments.

- Considerations:

- Prices may be lower due to hosting costs.

- Limited to local availability.

- Advantages:

-

Independent Gold Buyers:

- Advantages:

- Face-to-face transactions with independent buyers.

- Potential for personalized service and negotiations.

- Considerations:

- Reputation and reliability vary.

- Prices may not be as competitive.

- Advantages:

-

Local Jewelers and Goldsmiths:

- Advantages:

- Expertise in evaluating gold items.

- Potential for customized design options.

- Considerations:

- Prices may vary based on the jeweler's policies.

- Focus on craftsmanship rather than gold value.

- Advantages:

-

Community Bulletin Boards and Classifieds:

- Advantages:

- Direct sales to local individuals.

- Potential for negotiations.

- Considerations:

- Limited reach and may require more effort to find a buyer.

- Limited security and no guarantees.

- Advantages:

What Are Your Online Options?

When exploring online options for selling gold, numerous reputable platforms provide a convenient and efficient way to unlock the value of your precious metal. Here are some popular online options to consider:

-

Online Gold Buyers:

- Advantages:

- Wide market reach for competitive pricing.

- Streamlined process with clear instructions.

- Considerations:

- Research and choose a reputable buyer with positive reviews.

- Understand shipping and insurance policies.

- Advantages:

-

Gold Dealers:

- Advantages:

- Direct access to gold bullion.

- Potential for higher payouts for gold coins and bars.

- Considerations:

- Verify the reputation of the dealer.

- Be aware of dealer fees that may apply.

- Advantages:

-

Specialized Gold Exchanges:

- Advantages:

- Dedicated platforms for buying and selling gold.

- Transparent pricing and efficient transactions.

- Considerations:

- Verify the legitimacy of the exchange.

- Understand transaction fees and withdrawal processes.

- Advantages:

-

Online Auctions:

- Advantages:

- Potential for competitive bidding.

- Suitable for unique or high-value items.

- Considerations:

- Choose reputable auction platforms.

- Be aware of associated fees and commissions.

- Advantages:

-

Precious Metal ETFs (Exchange-Traded Funds):

- Advantages:

- Investment-based approach without physically selling gold items.

- Liquidity and flexibility.

- Considerations:

- Understand ETF mechanics and associated risks.

- Monitor market conditions for optimal selling times.

- Advantages:

-

Online Marketplaces:

- Advantages:

- Direct sales to individuals.

- Potential for negotiations.

- Considerations:

- Exercise caution and ensure secure transactions.

- Limited to the reach of the specific online marketplace.

- Advantages:

-

Referral Websites:

- Advantages:

- Platforms that connect sellers with reputable buyers.

- Simplifies the selling process.

- Considerations:

- Verify the legitimacy of the referral website.

- Understand any associated fees.

- Advantages:

Before choosing an online option or sell gold near me, it's crucial to research and verify the legitimacy of the platform or buyer. Reading customer reviews, understanding the terms of the transaction, and considering the specific advantages and limitations of each option will help you make an informed decision when selling gold online.

Why We Recommend Gold to Cash, afterall?

-

Competitive Pricing:

- We are a reputable gold buyer offering most competitive prices for your gold items. We provide a fair market value, ensuring you receive a satisfactory return on your investment.

-

Transparent Processes:

- Our process is completely transparent, clearly outlining how we evaluate gold, determine its value, and calculate the final payment. This transparency fosters trust and confidence in the selling process.

-

Quick Turnaround:

- We strive to process payments promptly. We guarantee a payment with 24 hours, however most of the time its within a few hours of receiving your package. This quick turnaround ensures you can access the funds from your gold sale in a timely manner.

-

Insured Shipping:

- To enhance the security of the transaction, we provide insured shipping for up to $5,000 automatically. This safeguards your gold items during transit, giving you peace of mind throughout the selling process.

-

Positive Customer Reviews:

- A strong recommendation often comes from positive experiences shared by previous customers. Gold to Cash consistently receives 5-star reviews. It suggests a high level of customer satisfaction and reliability.

-

Accessibility:

- Online gold buying service - Gold to Cash provides a convenient and accessible option, allowing you to sell your gold from the comfort of your home. This can be particularly beneficial for those who prefer remote transactions.

-

Reputation and Trust:

- We have a solid reputation within the industry. This reputation is built on trust, reliability, and fair dealings, ensuring that customers have confidence in the service's integrity.

-

Bonus or Incentive Programs:

- Also, we offer a bonus program or incentives to encourage sellers. We provide additional 10% bonus for expedited transactions or items shipped back within 7 days.

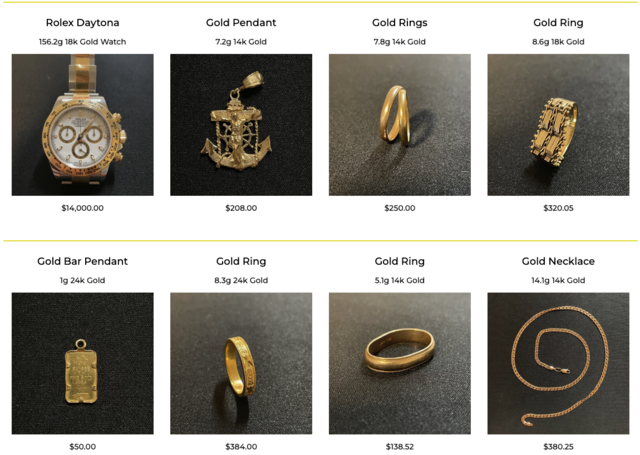

What Can You Sell?

GOLD TO CASH IS MORE THAN JUST A GOLD BUYER, WE BUY EVERYTHING THAT CONTAINS GOLD OR OTHER PRECIOUS METALS AND PAY MOST MONEY.

JEWELRY

- Rings, necklaces, earrings, bracelets, pendants.

- All purities and sizes.

- Gold, silver, platinum.

- New, used, broken and damaged.

- Designer jewelry and luxury watches.

COINS

- Any gold, silver and platinum coins.

- Collectible gold and silver coins.

- Gold of any country and denomination.

PRECIOUS METALS BULLION

- Any gold, silver and platinum bullion.

- Bars of any weight.

- Rounds of any weight.

GOLD

- Gold dentures.

- Gold granules.

- Gold nuggets.

How to Distinguish Genuine Gold from Counterfeits

Distinguishing real gold from fake gold involves a combination of visual inspection, basic tests, and sometimes more advanced methods. Here are several techniques to help you determine whether the gold you have is genuine:

-

Check for Hallmarks and Stamps:

- Authentic gold items often have hallmarks or stamps indicating the karatage, such as 10k, 14k, 18k, or 24k. Examine the item for these markings, but note that some fake items may also bear stamps.

-

Color and Luster:

- Real gold has a distinct, warm color and a natural luster that does not tarnish or corrode. If the gold item exhibits unusual discoloration, it may be a sign of a fake or lower karat gold.

-

Magnet Test:

- Gold is not magnetic. If a piece of jewelry or gold coin is attracted to a magnet, it is likely not genuine gold. Keep in mind that some fake gold items may be composed of non-magnetic materials.

-

Density Test:

- Gold is a dense metal. While this method is not foolproof, comparing the weight of a gold item to its volume can provide an indication of its density. Genuine gold will be heavier than most other metals of similar size.

-

Ceramic Plate Test:

- Rub the gold item against a ceramic plate. Real gold will leave a gold streak, while fake gold made of other materials may leave a black streak.

-

Nitric Acid Test:

- A more advanced method involves applying a small amount of nitric acid to the gold item. Real gold does not react to nitric acid, while fake gold may produce a reaction. However, this test can damage the item and should be performed cautiously.

-

Professional Appraisal:

- If in doubt, seek the expertise of a professional appraiser or jeweler. They have the tools and knowledge to accurately assess the authenticity and value of gold items.

-

Hallmark Verification:

- Verify the hallmark using a jeweler's loupe or a magnifying glass. Authentic hallmarks are usually crisp and well-defined, while fake items may have blurry or poorly engraved markings.

-

Use of a Gold Testing Kit:

- Gold testing kits are available and can be used to conduct acid tests or electronic tests at home. Follow the instructions carefully to get accurate results.

Remember that these methods are not infallible, and some fake gold items may be sophisticated enough to pass some tests. If you are uncertain about the authenticity of your gold, it is advisable to consult with a professional jeweler or appraiser who can provide a more accurate assessment.

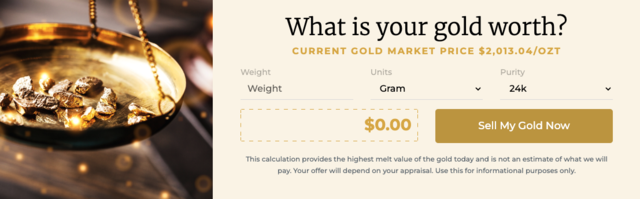

Understanding How Much You Can Get for Your Gold

The amount you can get for your gold depends on various factors, and it's influenced by the weight, purity (karats), and the current market price of gold. Additionally, the method you choose to sell your gold, whether through a local buyer, online service, or other avenues, can impact the final payout.

Here are key factors that influence how much you can get for your gold:

-

Gold Weight:

- The weight of your gold items, usually measured in grams or troy ounces, is a primary determinant of value. The heavier the gold, the higher the potential payout.

-

Gold Purity (Karats):

- Gold purity is measured in karats (e.g., 24k, 18k, 14, 10k). Higher karat gold contains a higher percentage of pure gold and is generally more valuable. The karatage of your gold items significantly influences the overall value.

-

Current Market Price:

- The current market price of gold is a crucial factor in determining its value. Gold prices fluctuate based on global economic conditions, supply and demand, and geopolitical factors. Stay informed about the current market price to estimate the value of your gold.

-

Buyer's Offer:

- Different buyers may offer different prices for your gold. Local jewelers, pawn shops, online gold buyers, and refiners may have varying payout structures. Obtaining multiple quotes from reputable buyers allows you to compare offers and choose the best option.

-

Transaction Costs:

- Some buyers may charge fees or deduct expenses such as dealer costs, shipping, or handling. Be aware of any associated costs that may affect the final amount you receive.

-

Condition and Design:

- The condition and design of your gold items can also influence their value. Unique or well-crafted pieces may command higher prices beyond their intrinsic gold value.

-

Negotiation Skills:

- If you are selling to a local buyer, your negotiation skills can play a role in the final agreed-upon price. Polite and informed negotiation may lead to better terms.

To get an estimate of the value of your gold, you can use an online gold calculator that considers weight, purity, and the current market price. However, for an accurate assessment, it's recommended to consult with reputable buyers or appraisers who can factor in additional considerations.

Remember that the gold market is dynamic, and prices can change. It's advisable to do thorough research, obtain multiple quotes, and choose a reliable buyer to ensure you get the best value for your gold.

Current Gold Market Price

As of the most recent update, the price of gold remains subject to dynamic fluctuations influenced by a myriad of global factors. Gold, a precious metal often considered a safe-haven asset, plays a crucial role in the financial markets. As of February 19th, the market price for gold stands at $2,013 per ozt, reflecting the ever-changing landscape of economic conditions, geopolitical tensions, and investor sentiment.

The gold market is intricately connected to macroeconomic indicators such as inflation rates, interest rates, and currency values. In times of economic uncertainty or inflationary pressures, gold tends to be sought after as a store of value, contributing to upward price movements. Conversely, during periods of economic stability and optimism, the demand for gold may soften, impacting its market price.

Global geopolitical events also exert a significant influence on gold prices. Political tensions, trade disputes, and other uncertainties can drive investors towards gold as a safe-haven asset, leading to increased demand and higher prices. Conversely, resolutions to geopolitical issues may contribute to a decrease in gold prices.

Central bank policies, particularly regarding interest rates, are critical factors affecting the gold market. Changes in interest rates influence the opportunity cost of holding gold, with higher interest rates potentially diverting investors towards interest-bearing assets.

It's important to note that the gold market is highly sensitive and can experience rapid shifts in response to breaking news or unexpected events. Investors and market participants closely monitor these factors to anticipate and respond to changes in gold prices.

For the most accurate and up-to-date information on the current gold price, it is recommended to check reputable financial news sources, financial websites, or consult with financial experts who closely follow the precious metals market.

Is It Worth Selling Gold Now?

Determining whether it's worth selling gold at $2,013 per ozt depends on various factors, and the decision should be based on your individual financial circumstances and goals. Here are some considerations:

-

Current Market Conditions:

- Assess the current price of gold. If the market is experiencing a high point, it might be a favorable time to sell. However, predicting market movements can be challenging, so staying informed about trends is crucial.

-

Financial Need:

- Consider your immediate financial needs. If you require cash for emergencies, investments, or other priorities, selling gold could provide a source of funds.

-

Long-Term Outlook:

- Evaluate your long-term investment strategy. If you believe that the price of gold may increase further in the future, you might choose to hold onto your gold assets.

-

Diversification:

- Assess the diversification of your overall investment portfolio. Gold is often used as a hedge against economic uncertainties, so selling or retaining gold should align with your broader investment strategy.

-

Personal Circumstances:

- Consider any personal circumstances that may influence your decision. Life events, changes in financial goals, or adjustments to your investment strategy can impact the decision to sell gold.

-

Transaction Costs:

- Be aware of any transaction costs associated with selling gold. These costs could include fees from a broker, shipping charges, or other expenses that may affect the overall return.

-

Tax Implications:

- Understand the tax implications of selling gold. Depending on your location and tax laws, selling gold may have tax consequences, and it's advisable to be aware of these before making a decision.

-

Market Sentiment:

- Consider broader market sentiment and economic indicators. Changes in global economic conditions, geopolitical events, or shifts in investor sentiment can influence the demand and value of gold.

Before deciding to sell gold, it's recommended to weight in all the factors listed above. Additionally, staying informed about current market conditions and trends will help you make a more informed and strategic decision regarding your gold holdings. The current market is considered high and is only a little below the all time high mark. Therefore, if you need to cash in on some of your gold, it is a very favorable time to do so.

What Makes Gold So Valuable?

Gold, a timeless and precious metal, holding a unique allure that extends beyond its aesthetic appeal. Beyond its use in jewelry and adornments, gold's value is deeply rooted in its scarcity, durability, and universal acceptance as a store of wealth.

- Rarity and Scarcity:

One of the key factors driving the value of gold is its limited availability. Unlike currencies that can be printed endlessly, gold is a finite resource. The scarcity of gold enhances its perceived value, creating a sense of exclusivity and desirability. As a result, gold has maintained its allure as a symbol of wealth and luxury throughout history.

- Durability and Non-Corrosive Nature:

Gold is virtually indestructible, maintaining its luster and beauty over time. Unlike other metals, it does not corrode or tarnish, making it an ideal material for jewelry and other enduring artifacts. This durability contributes to gold's lasting value, ensuring that it retains its aesthetic and monetary worth across generations.

- Universality and Acceptance:

Gold is a truly global asset with universal appeal. Recognized and accepted across cultures and borders, gold serves as a reliable store of value and a medium of exchange. Its enduring acceptance in various forms, from coins to bars, contributes to its liquidity, allowing individuals to easily convert gold into cash or other assets.

- Hedge Against Inflation:

Gold has historically served as a hedge against inflation and economic uncertainties. When traditional currencies lose value due to inflationary pressures, gold tends to retain its purchasing power. Investors often turn to gold as a safe haven during times of economic instability, seeking to preserve and grow their wealth in the face of currency devaluation.

- Industrial and Technological Uses:

Beyond its role as a precious metal, gold possesses unique physical and chemical properties that make it indispensable in various industrial applications. Its conductivity, malleability, and resistance to corrosion make gold an essential component in electronics, medical devices, and other high-tech industries. This dual utility adds to the overall demand for gold, influencing its market value.

In essence, the value of gold is a culmination of its scarcity, durability, universality, and intrinsic properties. As a tangible and time-tested asset, gold continues to hold its allure as a symbol of wealth, a safe haven in uncertain times, and a versatile contributor to technological advancements. Understanding these factors helps demystify the enduring fascination and value associated with this precious metal.

Advantages of Selling to Gold to Cash

The decision where to sell gold depends on various factors, and each option has its advantages and considerations. However, there are more advantages for Gold to Cash than to any near me option.

Advantages of Selling to Gold to Cash:

-

National Reach:

- Gold to Cash has a broader national reach, allowing you to access a larger market. This will lead to more competitive pricing due to increased buyer competition.

-

Online Convenience:

- Selling to Gold to Cash offers the convenience of an online transaction. You can initiate the process from the comfort of your home, eliminating the need for in-person visits.

-

Transparent Process:

- Gold to Cash offers clear and transparent processe, including detailed instructions on how to send your items, track the shipment, and receive payment. This transparency can be reassuring for sellers.

-

Competitive Pricing:

- Gold to Cash operates in a competitive market, leading to more competitive pricing for your gold. The ability to receive quotes from multiple online buyers allows you to compare offers.

-

Insured Shipping:

- Gold to Cash offers insured FedEx shipping. This ensures the secure transportation of your gold items and provides added peace of mind during the selling process.