Whether you have gold jewelry, coins, bars, or other forms of gold, it's essential to know how to calculate its value accurately. Understanding the value of your gold can help you make informed decisions about selling, insuring, or investing in this precious metal. In this guide, we'll walk you through the steps to calculate the value of your gold. Also, you can use a gold calculator on our website to calculate the value of your gold.

Step 1: Determine the Purity (Karat) of Your Gold

The first step in calculating the value of your gold is to determine its purity, which is usually measured in karats (k). Gold purity can vary, with 24 karats being pure gold. Common purities include 18k, 14k, and 10k, where these numbers represent the proportion of gold in the alloy (e.g., 18k gold is 75% pure gold). Most gold items have their karat value stamped on them, but if not, you might need to get it tested by a jeweler or use an electronic gold tester.

Step 2: Weigh Your Gold

Accurate weight measurement is crucial when calculating the value of your gold. Gold is typically weighed in troy ounces, with one troy ounce equaling approximately 31.1035 grams. You can use a digital scale designed for weighing precious metals or visit a professional gold buyer or jeweler to have your gold items weighed.

Step 3: Check the Current Market Price of Gold

Gold prices fluctuate daily based on various factors like supply, demand, economic conditions, and geopolitical events. To find the current market price, you can check financial news websites, commodities exchanges, or use mobile apps that provide real-time gold price updates.

Step 4: Calculate the Pure Gold Content

To calculate the value of your gold, use the following formula:

Value = (Weight in grams) × (Purity) × (Current Market Price)

For example, if you have a 14k gold necklace weighing 33 grams and the current market price of gold is $1,940 per troy ounce:

- Dividing the troy ounce value ($1,940) by 31.1 gives us a per gram value of $62.38 for pure (24k) gold.

- $62.38 multiplied by .583 gives us a per gram price of $36.37 for 14k gold.

- $36.37 multiplied by 33g gives us a $1,200.21 value of your 14k gold necklace.

Step 5: Determine the Value

To calculate the value of your gold, multiply the pure gold content (in troy ounces) by the current market price of gold per troy ounce. Using the example above, if the current market price is $1,940 per troy ounce:

Value of Your Gold = $1,200.21

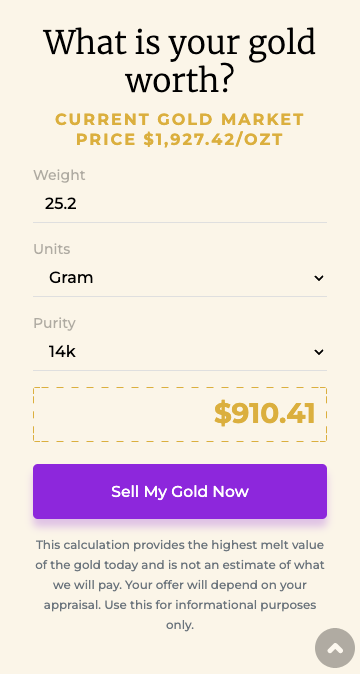

Its very helpful to know and understand the formula to calculate the value of your gold in case you dont have access to a gold calculator. if you want to calculate the gold value faster, you can use a gold calculator provided by Gold to Cash. It will give you an accurate highest melt value of gold based on the current market price. All you have to do is enter the weight of your gold item in grams or pennyweight and select the appropriate karat (gold purity). The gold calculator comes with live gold market price updates.

Step 6: Additional Considerations

While the above steps give you a basic calculation of your gold's value, there are a few additional factors to consider:

- Labor and Design: If your gold item has intricate craftsmanship or artistic value, it may be worth more than its pure gold content.

- Collectibility: Some gold coins or bars are highly sought after by collectors and can command premiums above their gold content value.

- Condition: The condition of your gold item matters, especially for jewelry. Scratches or damage can affect its value.

- Transaction Costs: When selling gold, be aware of any fees or commissions that might be associated with the sale.

Maximizing the Value When Selling Gold Jewelry

Now that you understand how to calculate your gold's melt value, let’s look at ways to ensure you get the best possible price for your gold jewelry.

1. Explore All Selling Options

Selling gold jewelry doesn't just mean heading straight to a local jeweler or pawn shop. While these buyers offer convenience and quick payment, they generally pay only for the melt value and may not consider any added value from design or craftsmanship. If your jewelry holds artistic, antique, or brand value (think Tiffany & Co. or Cartier), consider alternative routes:

- Private Sales: Selling directly to another individual—either online through platforms like eBay, Etsy, or even local marketplaces—allows you to find buyers who appreciate both the intrinsic and artistic worth of your jewelry.

- Auction Houses: For rare, vintage, or designer pieces, reputable auction houses like Sotheby's or Heritage Auctions can sometimes yield higher returns.

- Specialty Gold Buyers: Some buyers specifically look for designer pieces, estate jewelry, or gold items with collectible value.

2. Highlight the Unique Features

If your jewelry has notable craftsmanship, a unique design, or historic significance, showcase these aspects in your listing or negotiations. Quality photographs and clear, accurate descriptions help convey why your item is worth more than melt value alone.

3. Gather Documentation

Any appraisal certificates, designer marks, or original purchase receipts can boost buyer confidence and support a higher asking price. Professional appraisals, especially from accredited organizations like the American Gem Society, carry weight with discerning buyers.

4. Clean and Present Your Jewelry Well

A clean, sparkling piece makes a much better first impression. Just be careful to use safe cleaning methods suited for your particular item.

5. Be Patient for the Right Buyer

Securing the highest price often takes time and patience. If your jewelry has intrinsic or sentimental value (or both!), waiting for a buyer who values those qualities—rather than just the gold content—can be worth the extra effort.

6. Understand the Market

Track current trends and demand for gold jewelry styles—certain eras or designs may be in vogue, making your item more sought-after. Staying informed gives you the upper hand when negotiating.

Summary

To maximize the price you receive, resist settling for the quickest sale based solely on melt value. By exploring all your selling avenues, documenting your piece, and waiting for the right buyer, you can unlock additional value beyond the gold itself.

Should You Sell Gold Jewelry to Consumers or Jewelers? Pros and Cons

If you're weighing your options for selling gold jewelry, it's important to know the advantages and drawbacks of selling directly to other consumers versus going through jewelers or pawn shops.

Selling to Consumers

Pros:

- Typically, you'll get a higher price selling to an individual buyer, as private buyers often appreciate both the craftsmanship and sentimental value of jewelry—not just its gold content.

- If your piece has historical significance or a unique design, you might find someone willing to pay a premium above the melt value.

Cons:

- Finding the right buyer can take time and effort. You might need to market your jewelry online (think places like eBay, Etsy, or local marketplaces) or network through friends and family.

- There may be more back-and-forth negotiation, and you’ll want to ensure a safe, secure transaction.

Selling to Jewelers or Pawn Shops

Pros:

- This is usually the fastest and most straightforward option. Many jewelers and pawn shops will assess and purchase your gold on the spot.

- Professional buyers will have the equipment to test gold purity and weight, and handle all the transaction details for you.

Cons:

- Offers from jewelers and pawn shops are generally based on "melt price"—the value of the raw gold rather than the design or provenance of your piece.

- You may receive less than you would in a private sale, as these businesses need to factor in their own margins and account for market fluctuations and refining fees.

Which Should You Choose?

The best path depends on your priorities: If maximizing value is more important and you have time to find the right buyer, selling directly to a consumer might be ideal. If you need cash quickly or prefer a simple, no-fuss process, a jeweler or pawn shop may be the way to go. Either way, knowing your gold’s melt value helps you negotiate confidently and make a well-informed decision.

Challenges of Reselling Gold Jewelry—Especially Custom Pieces

When it comes to reselling gold jewelry, especially custom creations, there are a few important hurdles you should be aware of before listing your piece.

-

Limited Buyer Pool: Custom items are often tailored to reflect your personal style or story, which can sometimes make them less appealing to the broader market. A design that’s perfect for you might not match the tastes or preferences of a typical buyer who’s looking for more mainstream styles from big brands like Tiffany & Co. or Cartier.

-

Trends and Styles: Like fashion, jewelry trends change. A custom piece may not align with current design trends, so it might take longer to find someone interested. Some buyers are specifically searching for the latest motifs, settings, or designer collections, which can make selling a one-of-a-kind item more challenging.

-

Size and Fit Issues: Jewelry—especially rings—must fit. Custom sizes or unique settings, particularly those with specialized center stones or intricate bands, may not be easily resized. This can limit the appeal to only those whose specifications match your item, or it might result in additional costs for modifications.

-

Resale Value Considerations: Because of these factors, resale offers for custom gold jewelry often reflect only the melt value—the price of the gold itself—rather than the full amount you originally paid (which included design and craftsmanship). Collectible or branded items typically retain value better because of their market recognition.

If your gold jewelry carries sentimental value or exceptional craftsmanship, you might want to take your time seeking out a private buyer or specialized auction house willing to appreciate its story and artistry. However, if you need a quick transaction, selling to a jeweler, gold dealer, or pawn shop remains the fastest route, though you’ll usually receive less than what you originally paid.

Making informed choices about how and where to sell helps ensure you find the right balance between convenience and maximizing the return on your gold jewelry.

Knowing how to calculate the value of your gold empowers you to make informed decisions about your gold assets. Whether you plan to sell, insure, or simply keep your gold, understanding its worth is crucial. Keep in mind that while the calculation process is straightforward, factors like purity, weight, and market conditions can influence the final value. If you have unique or valuable gold items, consider seeking a professional appraisal for the most accurate assessment. Also, please keep in mind that the gold calculator or manual calculation will give you the highest melt value of your gold. This does not mean that you should expect that amount if you decide to sell your gold jewelry. Please request an appraisal kit from Gold to Cash to appraise your gold and get an offer.